Asset Group (Window ID-252)

Window: Asset Group

Description: Group of Assets

Help: The group of assets determines default accounts. If a asset group is selected in the product category, assets are created when delivering the asset.

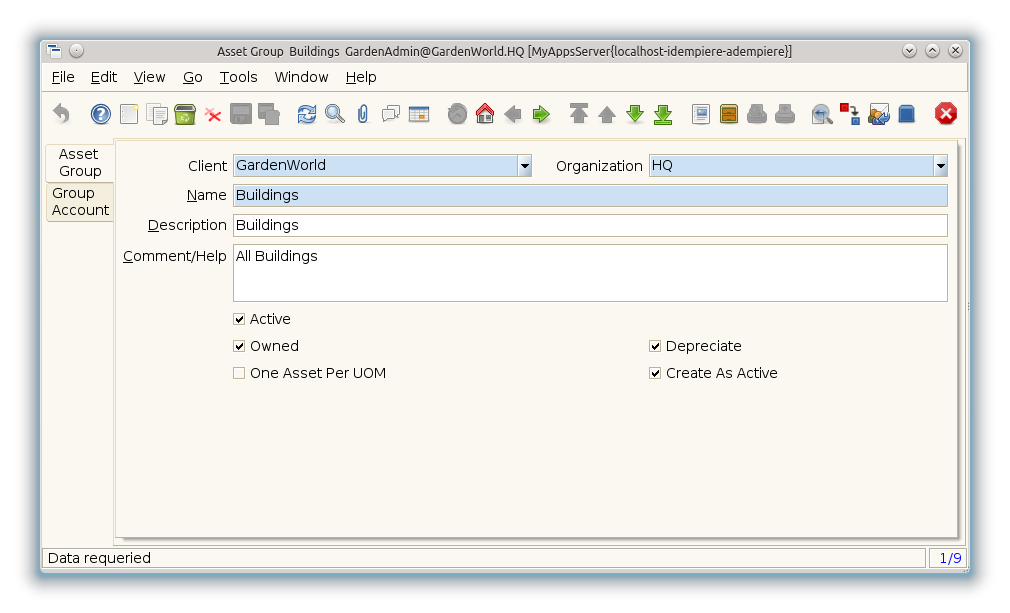

Tab: Asset Group

Description: Group of Assets

Help: The group of assets determines default accounts. If a asset group is selected in the product category, assets are created when delivering the asset.

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | A_Asset_Group.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | A_Asset_Group.AD_Org_ID numeric(10) Table Direct |

| Name | Alphanumeric identifier of the entity | The name of an entity (record) is used as an default search option in addition to the search key. The name is up to 60 characters in length. | A_Asset_Group.Name character varying(60) String |

| Description | Optional short description of the record | A description is limited to 255 characters. | A_Asset_Group.Description character varying(255) String |

| Comment/Help | Comment or Hint | The Help field contains a hint, comment or help about the use of this item. | A_Asset_Group.Help character varying(2000) Text |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

A_Asset_Group.IsActive character(1) Yes-No |

| Default | Default value | The Default Checkbox indicates if this record will be used as a default value. | A_Asset_Group.IsDefault character(1) Yes-No |

| Owned | The asset is owned by the organization | The asset may not be in possession, but the asset is legally owned by the organization | A_Asset_Group.IsOwned character(1) Yes-No |

| Depreciate | The asset will be depreciated | The asset is used internally and will be depreciated | A_Asset_Group.IsDepreciated character(1) Yes-No |

| One Asset Per UOM | Create one asset per UOM | If selected, one asset per UOM is created, otherwise one asset with the quantity received/shipped. If you have multiple lines, one asset is created per line. | A_Asset_Group.IsOneAssetPerUOM character(1) Yes-No |

| Is Fixed Asset | A_Asset_Group.IsFixedAsset character(1) Yes-No |

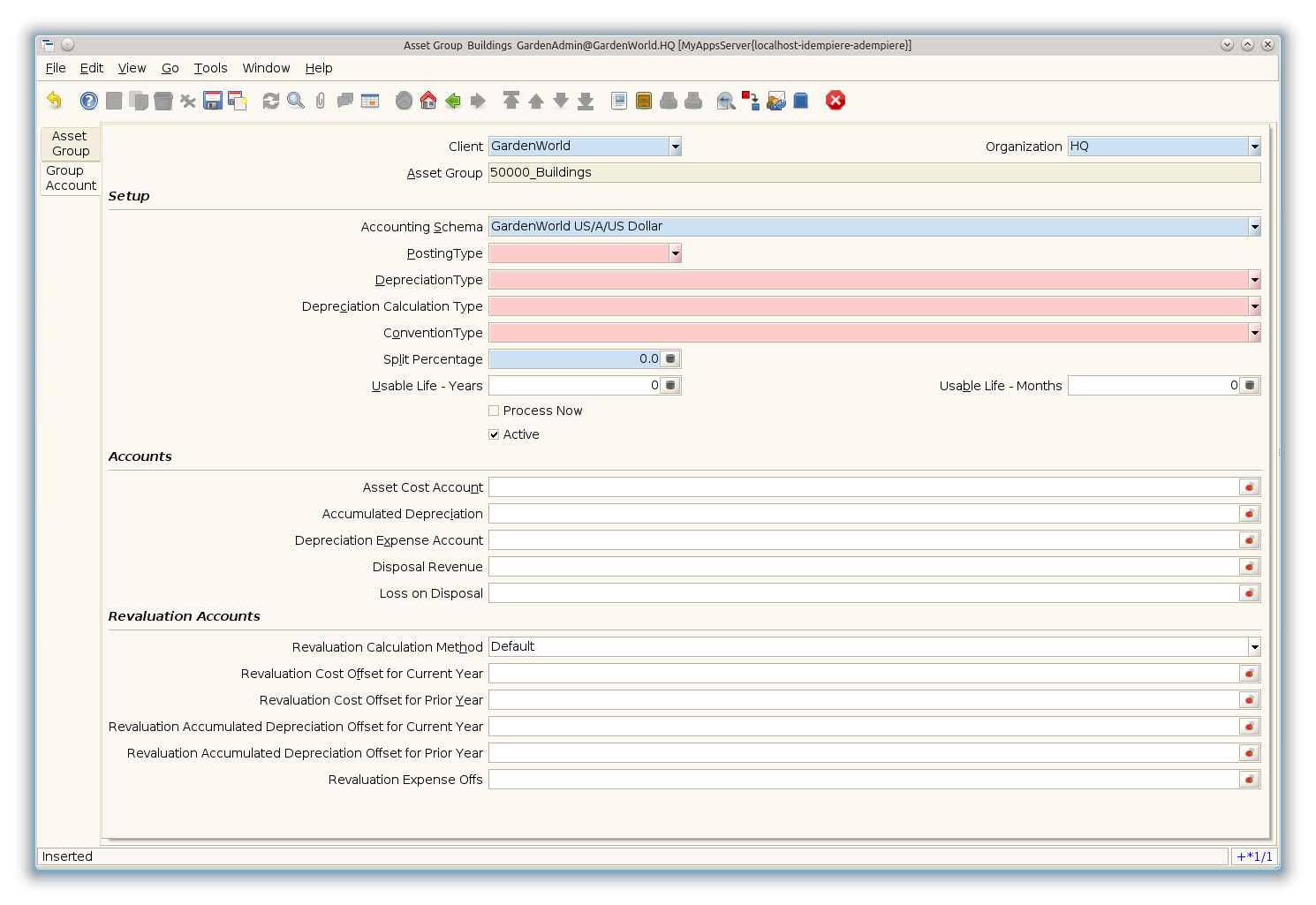

Tab: Group Account

Description: Setup for Group Accounts

Help:

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | A_Asset_Group_Acct.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | A_Asset_Group_Acct.AD_Org_ID numeric(10) Table Direct |

| Asset Group | Group of Assets | The group of assets determines default accounts. If an asset group is selected in the product category, assets are created when delivering the asset. | A_Asset_Group_Acct.A_Asset_Group_ID numeric(10) Table Direct |

| Accounting Schema | Rules for accounting | An Accounting Schema defines the rules used in accounting such as costing method, currency and calendar | A_Asset_Group_Acct.C_AcctSchema_ID numeric(10) Table Direct |

| Posting Type | The type of posted amount for the transaction | The Posting Type indicates the type of amount (Actual, Budget, Reservation, Commitment, Statistical) the transaction. | A_Asset_Group_Acct.PostingType character(1) List |

| Depreciation | A_Asset_Group_Acct.A_Depreciation_ID numeric(10) Table | ||

| Depreciation (fiscal) | A_Asset_Group_Acct.A_Depreciation_F_ID numeric(10) Table | ||

| Usable Life - Years | Years of the usable life of the asset | A_Asset_Group_Acct.UseLifeYears numeric Number | |

| Use Life - Years (fiscal) | A_Asset_Group_Acct.UseLifeYears_F numeric Number | ||

| Usable Life - Months | Months of the usable life of the asset | A_Asset_Group_Acct.UseLifeMonths numeric(10) Integer | |

| Use Life - Months (fiscal) | A_Asset_Group_Acct.UseLifeMonths_F numeric(10) Integer | ||

| Asset Acct | A_Asset_Group_Acct.A_Asset_Acct numeric(10) Account | ||

| Accumulated Depreciation Account | A_Asset_Group_Acct.A_Accumdepreciation_Acct numeric(10) Account | ||

| Depreciation Account | A_Asset_Group_Acct.A_Depreciation_Acct numeric(10) Account | ||

| Disposal Revenue Acct | A_Asset_Group_Acct.A_Disposal_Revenue_Acct numeric(10) Account | ||

| Disposal Loss Acct | A_Asset_Group_Acct.A_Disposal_Loss_Acct numeric(10) Account |

Tab: Translation

Description:

Help:

File:Asset Group - Translation - Window (iDempiere 1.0.0).png

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | A_Asset_Group_Trl.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | A_Asset_Group_Trl.AD_Org_ID numeric(10) Table Direct |

| Asset Group | Group of Assets | The group of assets determines default accounts. If an asset group is selected in the product category, assets are created when delivering the asset. | A_Asset_Group_Trl.A_Asset_Group_ID numeric(10) Search |

| Language | Language for this entity | The Language identifies the language to use for display and formatting | A_Asset_Group_Trl.AD_Language character varying(6) Table |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

A_Asset_Group_Trl.IsActive character(1) Yes-No |

| Translated | This column is translated | The Translated checkbox indicates if this column is translated. | A_Asset_Group_Trl.IsTranslated character(1) Yes-No |

| Name | Alphanumeric identifier of the entity | The name of an entity (record) is used as an default search option in addition to the search key. The name is up to 60 characters in length. | A_Asset_Group_Trl.Name character varying(60) String |

| Description | Optional short description of the record | A description is limited to 255 characters. | A_Asset_Group_Trl.Description character varying(255) String |

| Comment/Help | Comment or Hint | The Help field contains a hint, comment or help about the use of this item. | A_Asset_Group_Trl.Help character varying(2000) Text |