Depreciation Methods (Window ID-53058)

From iDempiere en

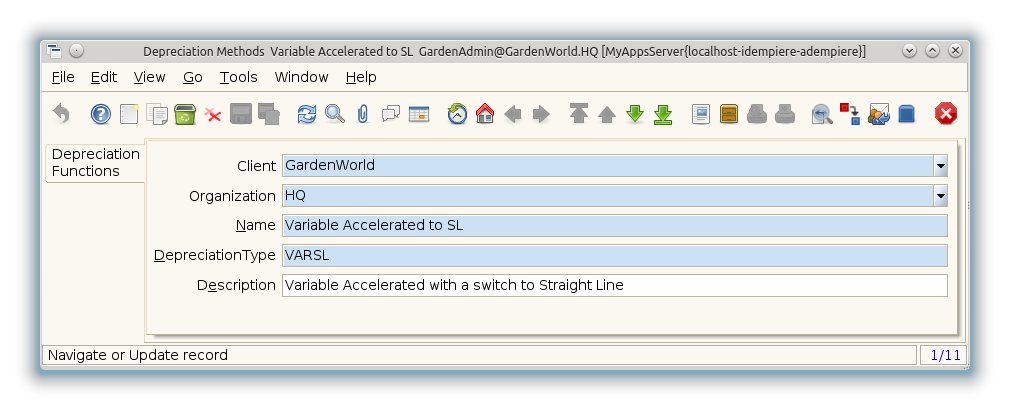

Window: Depreciation Methods

Description: Depreciation Methods

Help: The Depreciation method windows allows the user to review the depreciation calculations available in Adempiere

Tab: Depreciation Functions

Description:

Help:

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | A_Depreciation.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | A_Depreciation.AD_Org_ID numeric(10) Table Direct |

| Name | A_Depreciation.Name character varying(120) String | ||

| Depreciation Type | A_Depreciation.DepreciationType character varying(10) String | ||

| Description | Optional short description of the record | A description is limited to 255 characters. | A_Depreciation.Description character varying(510) String |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

A_Depreciation.IsActive character(1) Yes-No |