Revenue Recognition (Window ID-174)

Window: Revenue Recognition

Description: Revenue Recognition Rules

Help: The Revenue Recognition Window defines the intervals at which revenue will be recognized. Alternatively, the revenue recognition may be linked to service levels provided.

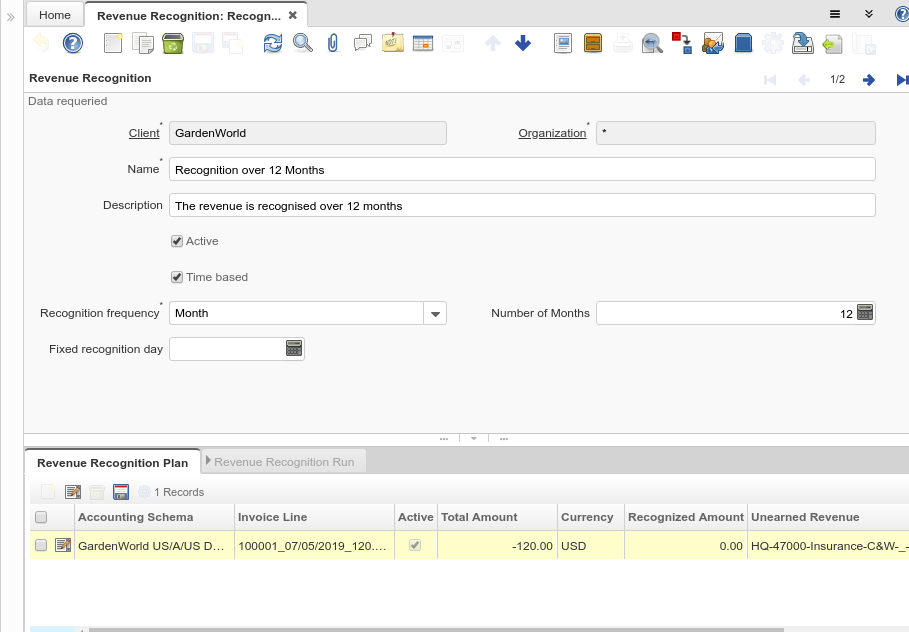

Tab: Revenue Recognition

Description: Revenue Recognition

Help: The Revenue Recognition Tab defines the intervals at which revenue will be recognized. You can also base the revenue recognition on provided Service Levels.

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | C_RevenueRecognition.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | C_RevenueRecognition.AD_Org_ID numeric(10) Table Direct |

| Name | Alphanumeric identifier of the entity | The name of an entity (record) is used as an default search option in addition to the search key. The name is up to 60 characters in length. | C_RevenueRecognition.Name character varying(60) String |

| Description | Optional short description of the record | A description is limited to 255 characters. | C_RevenueRecognition.Description character varying(255) String |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

C_RevenueRecognition.IsActive character(1) Yes-No |

| Time based | Time based Revenue Recognition rather than Service Level based | Revenue Recognition can be time or service level based. | C_RevenueRecognition.IsTimeBased character(1) Yes-No |

| Recognition frequency | C_RevenueRecognition.RecognitionFrequency character(1) List | ||

| Number of Months | C_RevenueRecognition.NoMonths numeric(10) Integer | ||

| Fixed recognition day | Day of the period recognition occurs | The Fix Recognition Day indicates the day of the period that unearned revenue is recognised. If zero, the invoice date is used. | C_RevenueRecognition.FixedRecogDay numeric(10) Integer |

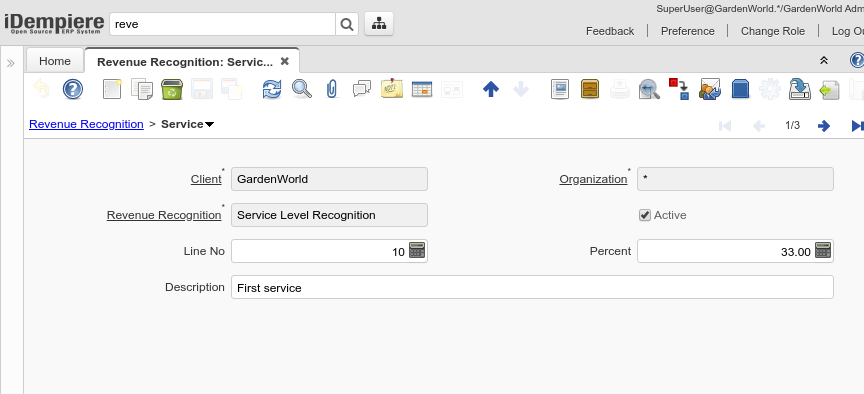

Tab: Service

Description:

Help:

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | C_RevenueRecog_Service.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | C_RevenueRecog_Service.AD_Org_ID numeric(10) Table Direct |

| Revenue Recognition | Method for recording revenue | The Revenue Recognition indicates how revenue will be recognized for this product | C_RevenueRecog_Service.C_RevenueRecognition_ID numeric(10) Table Direct |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

C_RevenueRecog_Service.IsActive character(1) Yes-No |

| Line No | Unique line for this document | Indicates the unique line for a document. It will also control the display order of the lines within a document. | C_RevenueRecog_Service.Line numeric(10) Integer |

| Percent | Percentage | The Percent indicates the percentage used. | C_RevenueRecog_Service.Percent numeric Amount |

| Description | Optional short description of the record | A description is limited to 255 characters. | C_RevenueRecog_Service.Description character varying(255) String |

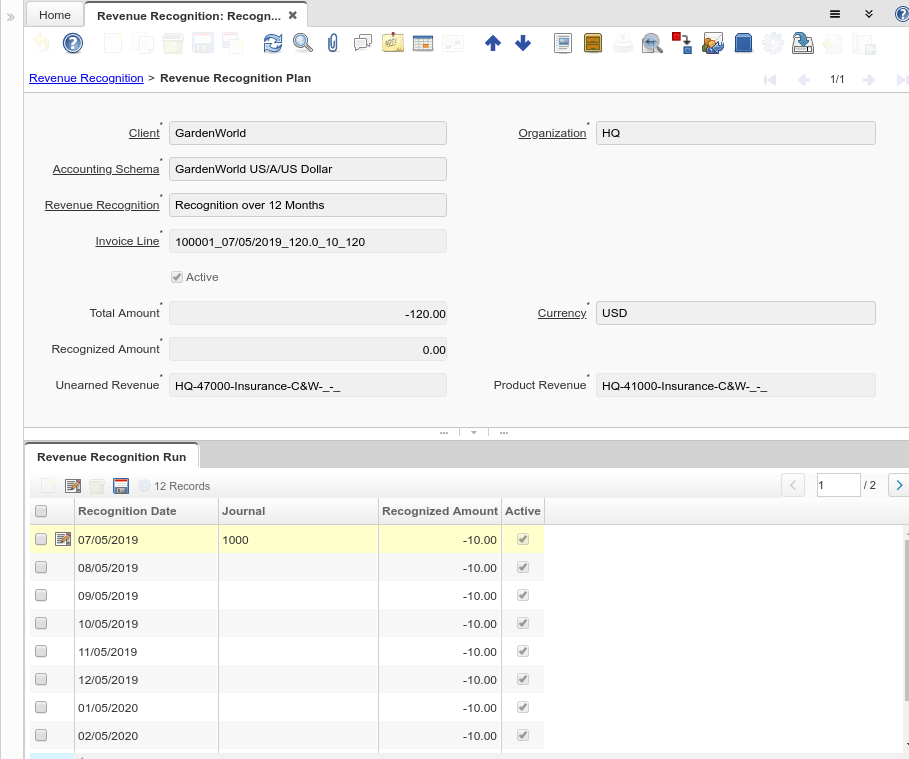

Tab: Revenue Recognition Plan

Description: View Revenue Recognition Plan

Help: The Revenue Recognition plan is generated then invoicing a product with revenue recognition. With Revenue Recognition, the amount is posted to the Unrecognized revenue and over time or based on Service Level booked to Earned Revenue.

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | C_RevenueRecognition_Plan.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | C_RevenueRecognition_Plan.AD_Org_ID numeric(10) Table Direct |

| Accounting Schema | Rules for accounting | An Accounting Schema defines the rules used in accounting such as costing method, currency and calendar | C_RevenueRecognition_Plan.C_AcctSchema_ID numeric(10) Table Direct |

| Revenue Recognition | Method for recording revenue | The Revenue Recognition indicates how revenue will be recognized for this product | C_RevenueRecognition_Plan.C_RevenueRecognition_ID numeric(10) Table Direct |

| Invoice Line | Invoice Detail Line | The Invoice Line uniquely identifies a single line of an Invoice. | C_RevenueRecognition_Plan.C_InvoiceLine_ID numeric(10) Search |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

C_RevenueRecognition_Plan.IsActive character(1) Yes-No |

| Total Amount | Total Amount | The Total Amount indicates the total document amount. | C_RevenueRecognition_Plan.TotalAmt numeric Amount |

| Currency | The Currency for this record | Indicates the Currency to be used when processing or reporting on this record | C_RevenueRecognition_Plan.C_Currency_ID numeric(10) Table Direct |

| Recognized Amount | C_RevenueRecognition_Plan.RecognizedAmt numeric Amount | ||

| Unearned Revenue | Account for unearned revenue | The Unearned Revenue indicates the account used for recording invoices sent for products or services not yet delivered. It is used in revenue recognition | C_RevenueRecognition_Plan.UnEarnedRevenue_Acct numeric(10) Account |

| Product Revenue | Account for Product Revenue (Sales Account) | The Product Revenue Account indicates the account used for recording sales revenue for this product. | C_RevenueRecognition_Plan.P_Revenue_Acct numeric(10) Account |

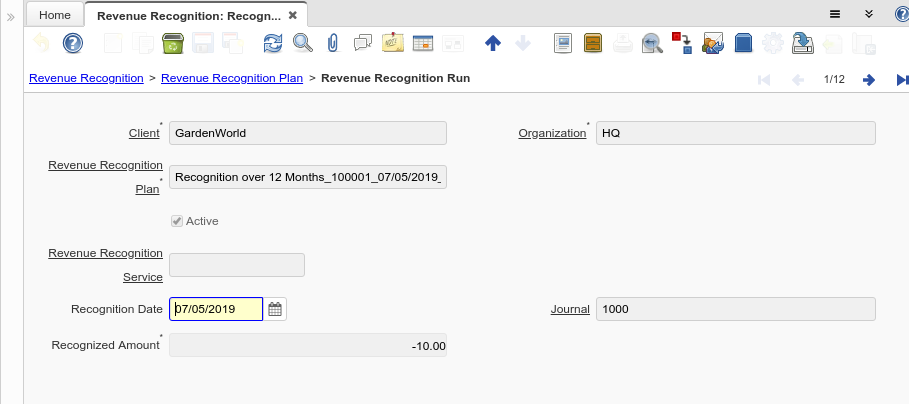

Tab: Revenue Recognition Run

Description: View Revenue Recognition Run History

Help:

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | C_RevenueRecognition_Run.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | C_RevenueRecognition_Run.AD_Org_ID numeric(10) Table Direct |

| Revenue Recognition Plan | Plan for recognizing or recording revenue | The Revenue Recognition Plan identifies a unique Revenue Recognition Plan. | C_RevenueRecognition_Run.C_RevenueRecognition_Plan_ID numeric(10) Table Direct |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

C_RevenueRecognition_Run.IsActive character(1) Yes-No |

| Revenue Recognition Service | C_RevenueRecognition_Run.C_RevenueRecog_Service_ID numeric(10) Table Direct | ||

| Recognition Date | C_RevenueRecognition_Run.DateRecognized timestamp without time zone Date | ||

| Journal | General Ledger Journal | The General Ledger Journal identifies a group of journal lines which represent a logical business transaction | C_RevenueRecognition_Run.GL_Journal_ID numeric(10) Search |

| Recognized Amount | C_RevenueRecognition_Run.RecognizedAmt numeric Amount |