Plugin: BX Service VAT Number Validator

- Maintainer: Diego Ruiz - Thomas Bayen - Carlos Ruiz - BX Service GmbH

- Sponsor: BX Service GmbH

- Status: Stable, used in production with release 11 and above

- License: GPLv2

- Sources: GitHub

Description

The goal of the plug-in is to allow the user to validate the VAT number of business partners within the European Union using the VIES API or the German eVatR API.

How to Use

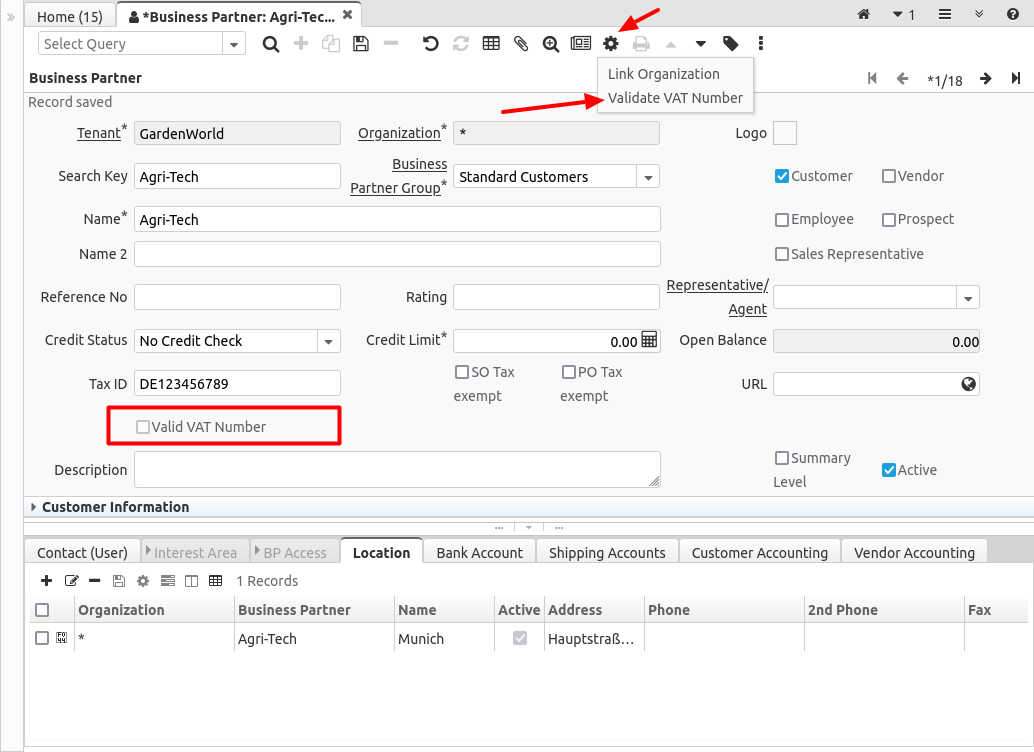

In the Business Partner window you see two new elements. A process in the Gear button and a Valid Vat Number flag under the Tax ID field.

The button appears only for records with TaxID filled.

After you push the button you must select the VAT Validation Service between eVatR and VIES.

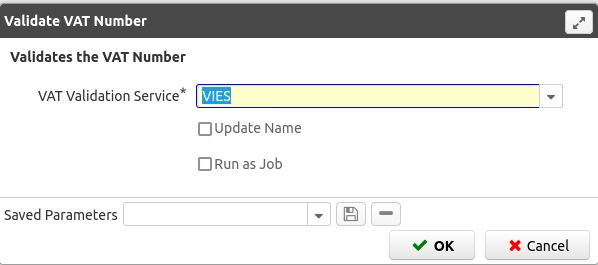

VIES VAT Validation

The VIES validation has an additional parameter Update Name, this is to update the Business Partner name with the name reported by the VIES website (if valid).

If the Tax ID is invalid, you will see an error message and the flag will remain unchecked.

If the validation is successful, the flag Valid VAT Number is marked. The plug-in unchecks the flag automatically when the Tax ID number is modified.

The plugin also shows the Address reported by the VIES site to help you compare with your registered address.

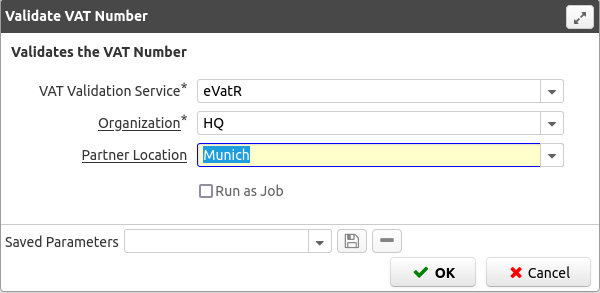

eVatR VAT Validation

The eVatR validation has two additional parameters:

- Organization: (mandatory) This is used to obtain the Tax ID of the validation requester.

- Partner Location: (optional) This is to additionally request validation of the business partner address, city and postal code.

This plugin returns a code and an error message stating if the VAT is valid or not, and the reason why is not valid.

The Valid VAT Number is marked appropriately depending on the result.

The business partner name is also validated and an answer is returned indicating if the firma name matches or not what is registered in the eVatR site.

Additionally if you passed an address parameter, the answer will indicate also if the address, postal code and city matches the information in the eVatR site.

Additional Notes

You can use this plugin together with the document status validator plugin to forbid sales order to be completed when the VAT number is not valid.