NF10 Deductible And Non Deductible Input Tax

From iDempiere en

Feature: Deductible and Non Deductible Input Tax

Goal: Functional

Feature Ticket: IDEMPIERE-5057

Description:

Implement support for https://techconcepthub.com/deductible-tax-and-non-deductible-tax/

Changes:

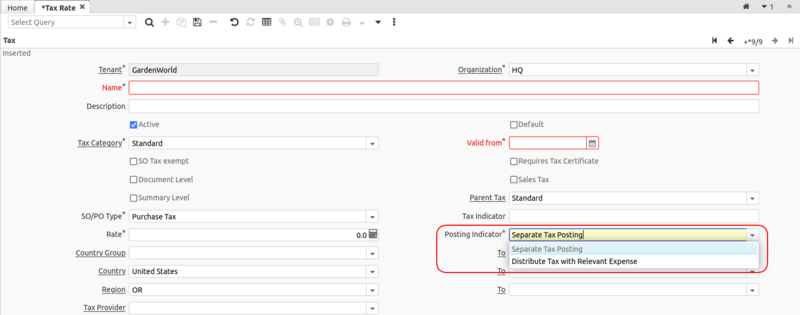

- Add Tax Posting Indicator field to Tax Rate window (for non-summary, line level purchase tax).

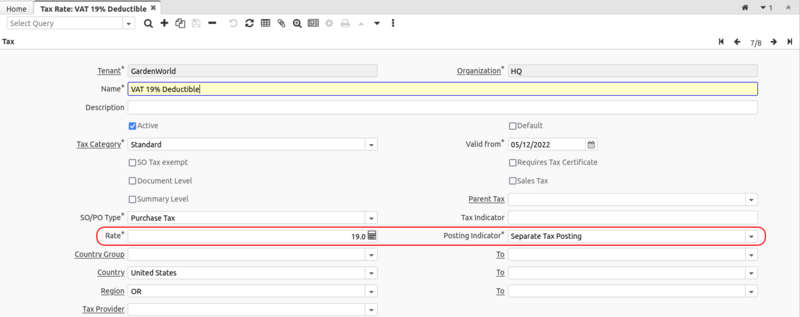

- Separate tax posting: For deductible input tax. This is the existing tax posting where tax is posted to a separate GL account from product asset account (i.e tax not added to product cost).

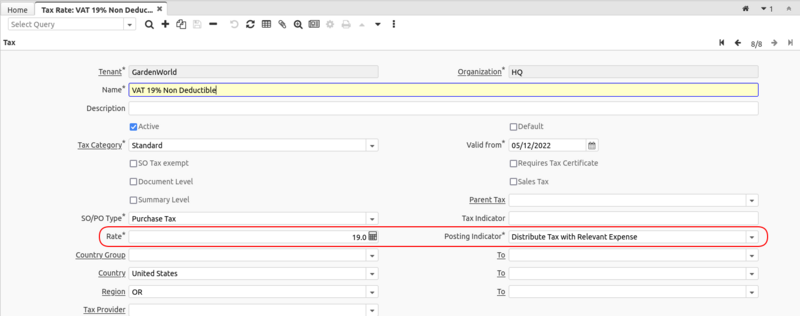

- Distribute tax with relevant expense: For non deductible input tax. Tax is posted to the product asset account and added to product cost.

- Modify tax and cost posting for Doc_Invoice, Doc_InOut, Doc_MatchInv and Doc_MatchPO.

Example:

- Setup Deductible Purchasing Tax Rate.

- Setup Non-Deductible Purchasing Tax Rate.

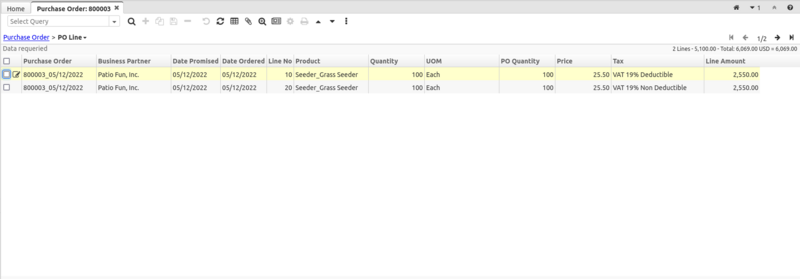

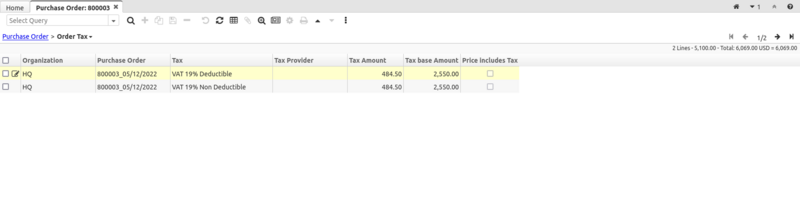

- Create 2 PO line, line 10 is using Deductible tax rate and line 20 is using Non-Deductible tax rate (both with 19% tax rate).

- 2 Order tax line created with Base Amount of 2550.00 and Tax Amount of 484.50.

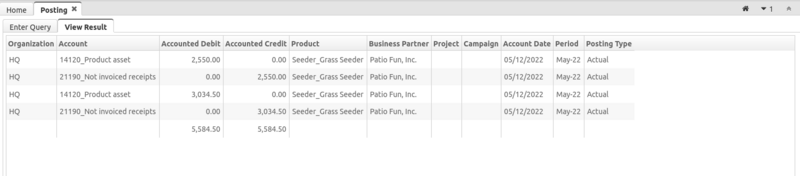

- Material Receipt Posting. Line 10 posted 2550.00 to Product Asset account and Line 20 posted 3034.50 (2550.00+484.50) to Product Asset account.

- Vendor Invoice Posting. Line 10 posted 484.50 to tax account and Line 20 didn't post to tax account.