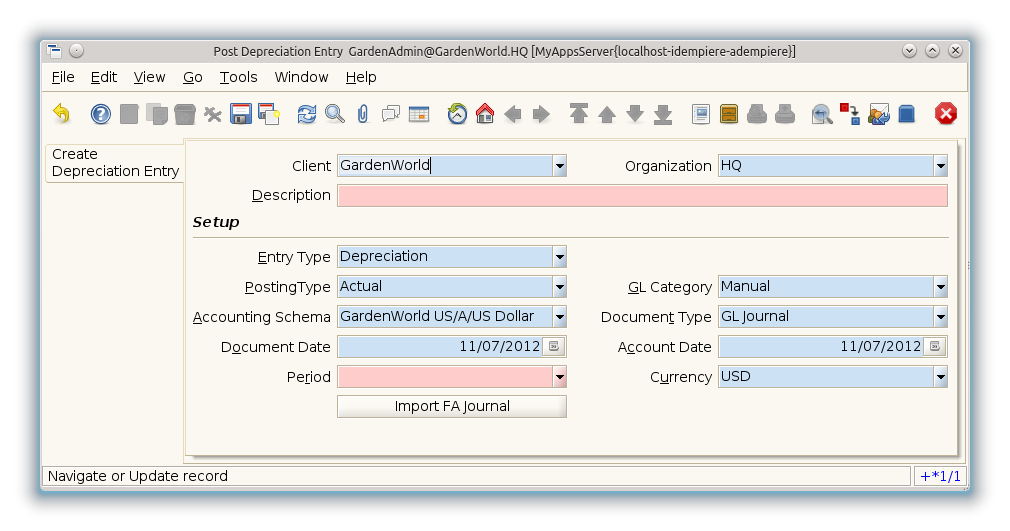

Post Depreciation Entry (Window ID-53053)

Window: Post Depreciation Entry

Description: Create Depreciation Entry

Help: The Depreciation Entry window allows you to create and post the depreciation expense entry to the GL

Tab: Create Depreciation Entry

Description:

Help:

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Tenant | Tenant for this installation. | A Tenant is a company or a legal entity. You cannot share data between Tenants. | A_Depreciation_Entry.AD_Client_ID numeric(10) Table Direct |

| Organization | Organizational entity within tenant | An organization is a unit of your tenant or legal entity - examples are store, department. You can share data between organizations. | A_Depreciation_Entry.AD_Org_ID numeric(10) Table Direct |

| Document No | Document sequence number of the document | The document number is usually automatically generated by the system and determined by the document type of the document. If the document is not saved, the preliminary number is displayed in "<>".

If the document type of your document has no automatic document sequence defined, the field is empty if you create a new document. This is for documents which usually have an external number (like vendor invoice). If you leave the field empty, the system will generate a document number for you. The document sequence used for this fallback number is defined in the "Maintain Sequence" window with the name "DocumentNo_<TableName>", where TableName is the actual name of the table (e.g. C_Order). |

A_Depreciation_Entry.DocumentNo character varying(60) String |

| Document Type | Document type or rules | The Document Type determines document sequence and processing rules | A_Depreciation_Entry.C_DocType_ID numeric(10) Table Direct |

| Description | Optional short description of the record | A description is limited to 255 characters. | A_Depreciation_Entry.Description character varying(510) String |

| Entry Type | A_Depreciation_Entry.A_Entry_Type character varying(3) List | ||

| Posting Type | The type of posted amount for the transaction | The Posting Type indicates the type of amount (Actual, Budget, Reservation, Commitment, Statistical) the transaction. | A_Depreciation_Entry.PostingType character(1) List |

| Accounting Schema | Rules for accounting | An Accounting Schema defines the rules used in accounting such as costing method, currency and calendar | A_Depreciation_Entry.C_AcctSchema_ID numeric(10) Table Direct |

| Document Date | Date of the Document | The Document Date indicates the date the document was generated. It may or may not be the same as the accounting date. | A_Depreciation_Entry.DateDoc timestamp without time zone Date |

| Account Date | Accounting Date | The Accounting Date indicates the date to be used on the General Ledger account entries generated from this document. It is also used for any currency conversion. | A_Depreciation_Entry.DateAcct timestamp without time zone Date |

| Period | Period of the Calendar | The Period indicates an exclusive range of dates for a calendar. | A_Depreciation_Entry.C_Period_ID numeric(10) Table |

| Document Status | The current status of the document | The Document Status indicates the status of a document at this time. If you want to change the document status, use the Document Action field | A_Depreciation_Entry.DocStatus character varying(2) List |

| Process Depreciation Entry | A_Depreciation_Entry.DocAction character(2) Button | ||

| Approved | Indicates if this document requires approval | The Approved checkbox indicates if this document requires approval before it can be processed. | A_Depreciation_Entry.IsApproved character(1) Yes-No |

| Posted | Posting status | The Posted field indicates the status of the Generation of General Ledger Accounting Lines | A_Depreciation_Entry.Posted character(1) Button |

Tab: Records

Description:

Help:

File:Post Depreciation Entry - Records - Window (iDempiere 1.0.0).png

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Depreciation Entry | A_Depreciation_Exp.A_Depreciation_Entry_ID numeric(10) Search | ||

| Asset | Asset used internally or by customers | An asset is either created by purchasing or by delivering a product. An asset can be used internally or be a customer asset. | A_Depreciation_Exp.A_Asset_ID numeric(10) Search |

| Entry Type | A_Depreciation_Exp.A_Entry_Type character varying(3) List | ||

| Description | Optional short description of the record | A description is limited to 255 characters. | A_Depreciation_Exp.Description character varying(255) String |

| Expense | A_Depreciation_Exp.Expense numeric Amount | ||

| Expense (fiscal) | A_Depreciation_Exp.Expense_F numeric Amount | ||

| Account (debit) | Account used | The (natural) account used | A_Depreciation_Exp.DR_Account_ID numeric(10) Account |

| Account (credit) | Account used | The (natural) account used | A_Depreciation_Exp.CR_Account_ID numeric(10) Account |

| Asset Period | A_Depreciation_Exp.A_Period numeric(10) Integer | ||

| Account Date | Accounting Date | The Accounting Date indicates the date to be used on the General Ledger account entries generated from this document. It is also used for any currency conversion. | A_Depreciation_Exp.DateAcct timestamp without time zone Date |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

A_Depreciation_Exp.IsActive character(1) Yes-No |

| Depreciate | The asset will be depreciated | The asset is used internally and will be depreciated | A_Depreciation_Exp.IsDepreciated character(1) Yes-No |

| Posting Type | The type of posted amount for the transaction | The Posting Type indicates the type of amount (Actual, Budget, Reservation, Commitment, Statistical) the transaction. | A_Depreciation_Exp.PostingType character(1) List |

| Processed | The document has been processed | The Processed checkbox indicates that a document has been processed. | A_Depreciation_Exp.Processed character(1) Yes-No |