Depreciation Calculation Method (Window ID-53061)

From iDempiere en

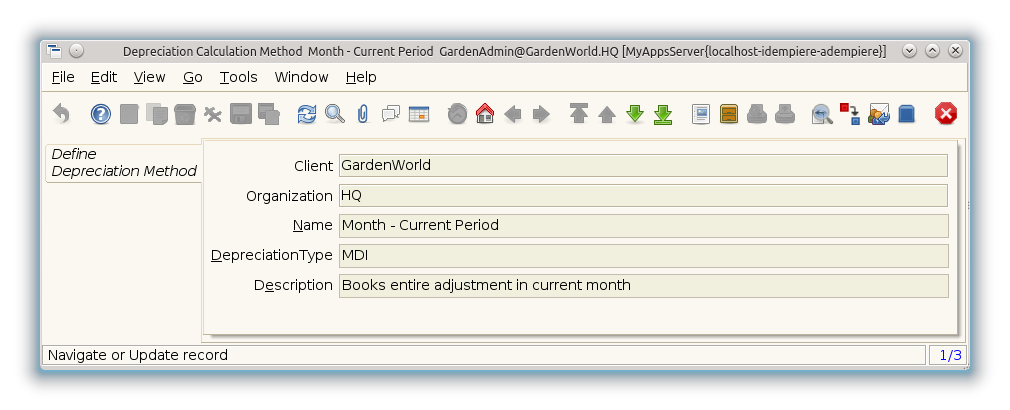

Window: Depreciation Calculation Method

Description: Define Calculation Methods used in depreciation expense calculation

Help: The Depreciation Calcualtion Method window allows the user to define how adjustments to the fixed asset depreciation expense are handled

TAB: Define Depreciation Method

Description: Define Depreciation Method

Help null

| Name | Name | Description | Help | Specifications |

|---|---|---|---|---|

| Client | Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID numeric(10) NOT NULL Table Direct |

| Organization | Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID numeric(10) NOT NULL Table Direct |

| Name | Name | Alphanumeric identifier of the entity | The name of an entity (record) is used as an default search option in addition to the search key. The name is up to 60 characters in length. | Name character varying(120) String |

| DepreciationType | DepreciationType | null | null | DepreciationType character varying(10) String |

| Description | Description | Optional short description of the record | A description is limited to 255 characters. | Description character varying(510) String |

| Text | Text | null | null | Text character varying(2000) Memo |

| Processed | Processed | The document has been processed | The Processed checkbox indicates that a document has been processed. | Processed character(1) NOT NULL Yes-No |